Banking Ombudsman

RBI, plays a crucial role in protecting

the interests of bank customers. RBI introduced the Banking Ombudsman Scheme

(BOS) on June 14, 1995, to protect customer's interests. This scheme acts as a

quick and affordable way to resolve customer complaints about shortcomings in

banking services. The scheme has gained wider acceptance among bank customers

over the years.

An Ombudsman known as the grievance-man,

or someone who deals with complaints. This is a senior official appointed by

the RBI for a maximum of three years at a time, to investigate and resolve

customer complaints against banks. As of November 2023, there were 24 Ombudsmen

with offices mainly in state capitals at RBI locations. The Banking Ombudsman

Scheme is administered by RBI through different Banking Ombudsman Offices

across the country, including rural and semi-urban areas, to make it accessible

to more people. The scheme has been revised five times since it started, with

the most recent updation in July 2017.

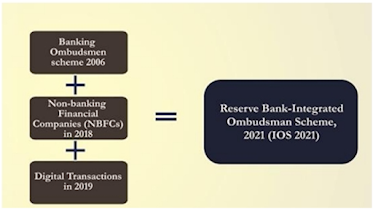

The Ombudsman Scheme covers Commercial

Banks, Regional Rural Banks, and Scheduled Primary Co-operative Banks. RBI

introduced two more schemes: one for Non-banking Financial Companies (NBFCs) in

2018 and another for digital transactions in 2019. However, on November 12,

2021, RBI consolidated all three schemes into a single comprehensive scheme

called the Reserve Bank-Integrated Ombudsman Scheme, 2021 (IOS 2021). This new

scheme covers all entities regulated by RBI, including Non-Scheduled Primary

Co-operative Banks with a deposit size of Rs. 50 crore and above. This

simplified scheme promotes a "One Nation One Ombudsman" approach.

Key features of the

Bank-Integrated ombudsman scheme, 2021

·

This Scheme offers a free resolution of

customer complaints related to service issues with RBI-regulated banks. If a

customer doesn't receive a satisfactory response from the bank within 30 days

of filing a complaint and wants to explore other options for resolving grievances,

they can approach the banking ombudsman appointed by RBI for further

assistance. Now, Customers no longer need to figure out where to file a

complaint with the Ombudsman. Complaints won't be rejected just because they

don't fit under a specific scheme.

·

Under this scheme, all complaints are

initially received at the Central Receipts and Processing Centre (CRPC) in

Chandigarh. After a preliminary scrutiny, the CRPC forwards the complaint to

the relevant ombudsman.

·

RBI designates the geographical

jurisdiction for each ombudsman. The Ombudsman has the authority to handle and

resolve all grievances. Every year, on March 31st, the Ombudsman submits a

report to the RBI Deputy Governor outlining all activities from the previous

financial year.

·

The complaints against the bank will be

handled by the Principal Nodal Officer or a high-ranking official in the bank.

Banks must provide information about complaints to the ombudsman.

·

The ombudsmen aim to resolve complaints

through agreement, conciliation, or mediation between the bank and the

aggrieved parties. If a mutual agreement cannot be reached, the banking

ombudsman resolves the complaint by issuing an AWARD in accordance with the

scheme's provisions, unless rejection is necessary. Now, Banks can't appeal

against ombudsman decisions if they don't provide information. The Appellate

Authority for the scheme is the Executive Director in charge of Consumer

Education and Protection at RBI.

·

It is important to note that Complaints

can be filed anywhere, not just at a specific ombudsman office. A person with a

grievance can complain to CRPC either personally or through an authorized

representative. It can be filed through[1]

o

On line portal

o

Electronic mode through e-mail

o

Physical Mode by post, courier, or hand

delivery

Other initiatives of

RBI for Customers' Rights:

•

The first initiative is the Charter of

Customer Rights: In 2014-15, the RBI developed a "Charter of Customer

Rights" to strengthen consumer protection measures. This charter outlines

fundamental principles for safeguarding bank customers' rights. The Charter

consists of these five rights –

o

Right to Fair Treatment

o

Right to Transparency, Fair and Honest

Dealings

o

Right to Suitability

o

Right to Privacy

o

Right to Grievance Redress and

Compensation

In

compliance with the RBI's instructions, individual banks have developed and

implemented Customer Rights Policies that align with the principles outlined in

the Charter. The RBI continuously monitors the implementation of the Charter to

ensure effective regulatory oversight.

•

The second is the Internal Ombudsman in

Banks. The RBI introduced the Internal Ombudsman (IO) scheme in 2015 to

strengthen internal grievance redressal for bank customers. The Internal

Ombudsman, also known as the Chief Customer Service Officer (CCSO), provides an

initial grievance redressal mechanism before customers approach the Banking

Ombudsman. The IO examines all grievances wholly or partially rejected by the

banks. In 2018, the RBI updated the Internal Ombudsman Scheme to make the

Internal Ombudsman more independent and improve the monitoring of the IO

system.

•

The third initiative is Consumer

Education and Protection Cells at Regional Offices. In 2015-16, Consumer

Education and Protection Cells (CEP Cells) were established in every Regional

Office of RBI. Their purpose is to help customers in resolving the problems

with entities regulated by the RBI that are not covered in the Ombudsman

Scheme. •

•

The next initiative focuses on Consumer

Education. RBI aims to increase consumer awareness about grievance redressal

mechanisms and protect them from fraudulent activities in the name of the bank.

This awareness is spread through Town Hall events, Awareness Campaigns, and

participation in Melas and Exhibitions, providing information in Hindi and

local languages. RBI's efforts aim to educate the public about Ombudsman

Schemes, secure banking practices, grievance redressal channels, and various

loan schemes. Additionally, the 'RBI Kehta Hai' Public Awareness Initiative by

RBI educates consumers about banking regulations and facilities through SMS.

The initiative includes sending cautionary messages to warn against unsolicited

offers via emails, SMSes, or phone calls through RBI's SMS gateway.

L.Raguraman

(22UCM034)

Useful information to us

ReplyDeleteGood information

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGood Information

ReplyDeleteNice information

ReplyDeleteNice information

ReplyDeleteNice information

ReplyDeleteGood information 👍🏻

ReplyDeleteGood information

ReplyDeleteGood information 👍🏻

ReplyDeleteGood information

ReplyDeleteNice information

ReplyDeleteNice information

ReplyDeleteGood 👍

ReplyDeleteGood 👍

ReplyDeleteGood information

ReplyDeleteNice 👍

ReplyDeleteNice information

ReplyDeleteGood information

ReplyDeleteGood

ReplyDeleteGood information

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDeleteNice information

ReplyDeleteUseful information👍

ReplyDeleteGood information 👍🏻

ReplyDeleteNice information

ReplyDeleteGood information

ReplyDeleteGOOD INFORMATION

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDeleteGood information 👍

Deletegood

ReplyDeleteGood information

ReplyDeleteGood information

ReplyDelete